We spoke to the experts atTrade Finance Global about some of the processes they’d recommend to finance directors when preparing the business for raising finance.

We spoke to the experts atTrade Finance Global about some of the processes they’d recommend to finance directors when preparing the business for raising finance.

Why do companies raise finance?

Raising finance is something that most companies will go through at some stage in their lifetime. SMEs, in particular, might look to raise initial funds to test a proof of concept or bring their product to market, whilst more established companies might look to debt funders to finance future cash flow or finance for growth in other markets.

Companies might raise finance for the following reasons:

- Short term cash flow or working capital needs to pay for the day-to-day running of the business whilst awaiting on payments

- Cash for overseas growth or expansion

- Testing / R&D to bring a product to market

- The purchase of up front machinery or equipment

Of the four points listed above, this article mainly covers the first and last point. Raising debt finance to ensure the business manages its balance sheet and cash flow position is the most common reason businesses struggle, and according to the FSB, accessing business finance is at the top of the agenda still for SME CEOs.

What types of finance are available for businesses?

Broadly speaking, there are two types of finance, equity funding, and debt funding. Equity (or venture capital) finance involves an investor taking a stake in your company in return for upfront finance and makes money when the company sells at a higher valuation. Debt finance normally requires some form of collateral or security, (although sometimes unsecured debt can be issued), and companies pay interest back on the debt that is issued. Debt finance means that the business owners will continue to retain full ownership of the company and pay interest back on any loans or debts they borrow. The most common form of debt finance for SMEs is invoice discounting and factoring – where companies sell invoices or purchase orders up front, in return for cash, knowing that buyers often delay payments for up to 90 days, which can be a huge hindrance on cash flow.

How can companies set themselves up to raise finance?

2016-2017 has seen much uncertainty in the way of currency volatility, political unrest, breaking up of trade blocks and a general ‘risk on’ approach in relation to trade. Set against this backdrop; it is of utmost importance that a company has mitigated as much risk as possible when raising finance. This comes down to company structure and understanding the potential negative contributing factors surrounding a specific type of trade.

Financial Controllers and CFOs in 2017 have a tough role of navigating businesses through volatility and unpredictability, as well as maintaining the day-to-day tasks of balance sheet management. When companies look to raise finance, it can often be very challenging to get a business ready for this stage.

Financial directors have to tackle not only balancing the books and ensuring working capital flows through the business but also future proofing and ensuring the business is set for growth; paving the way for strategic investments.

When raising finance, we’ve put together a few tips to prevent roadblocks and delays in raising capital from external sources.

Key Considerations for Raising Finance

- Currency plan for volatility – managing and hedging out potential currency risk

- Making sure that there are smart and sophisticated logistics and operations in place

- Understand your finances – future and previous cash flow forecasts. Make sure that there are no gaps or holes in processes and accounts

- Make sure you have a diversified supply chain. Make it clear that there is no heavy concentration on debtors or creditors

- Understanding the security structure of your debt/equity. What covenants and restrictions are there for bringing in debt or equity products?

- Roadblocks by difficult investors or directors

- Are there any potential risks, governmental policy changes or litigation claims that will affect operations?

It’s absolutely critical to fully understand the financing structure of a business and whether it is appropriate for the desired growth. Financial professionals should know the debt and equity security structures, which are operating. This includes any real or possible liabilities, potential litigation claims, along with any covenants or restrictions, which could adversely affect raising further finance.

Tackling the supply chain and understanding the end-to-end operations process is also important. Finance managers should ensure that there is a smart and well thought out operations process, as it’s not the only key to strengthening competitive advantage, but also reaffirming to a funder that robust back-end processes are in place; throughout the supply chain.

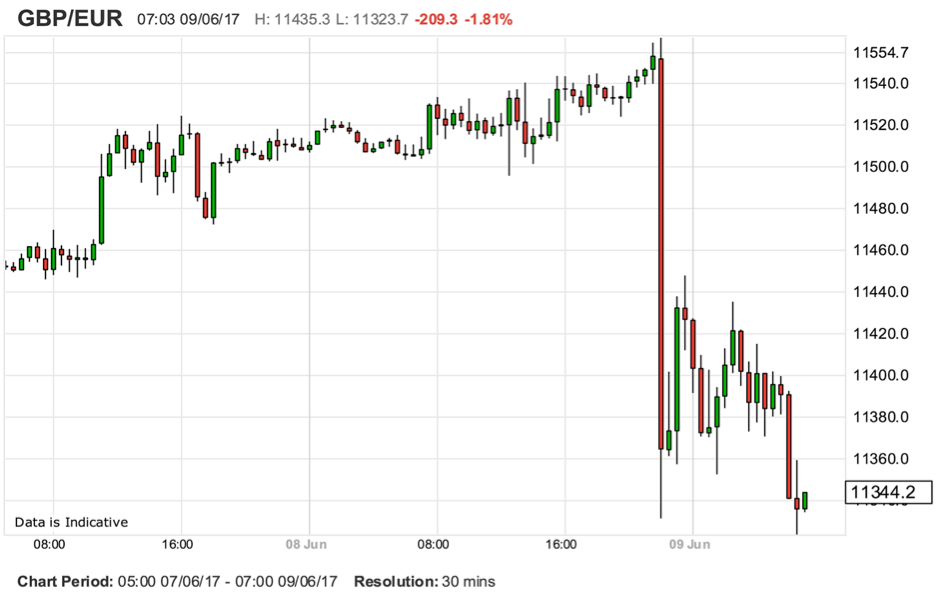

Financial professionals should also monitor currency volatility and hedging mechanisms. Given the volatility of most major currencies in 2017, not managing or planning in relation to currency trades of international trading companies can quickly mean high levels of risk on revenue and EBITDA; particularly those trading on thin margins. Currency volatility has been at the top of the agenda for many finance directors running international businesses given that businesses are focusing on exporting (now that the pound is weak) and that currency volatility can cost a business who doesn’t mitigate risks. As an example, following the news of a hung parliament in the UK general election last week, the pound slipped nearly 2% versus the euro. For businesses working with European sellers, the even weaker pound means that the cost of importing goods from Europe would have, in real terms, gone up. Any long term contracts which won’t be paid until 2-3 months might have to bear the costs of a weak pound, which means that this could directly hit the balance sheet of a company. Currency hedging would be a mechanism which businesses use to mitigate and shield themselves against this risk.

CAPTION: The Pound to Euro exchange rate set a low of 1.1286 on the morning of the 9th June following the general election, later stabilising to 1.1383 at the time of writing

It is important to understand both the internal and external risk factors affecting your company; prior to going to the debt or equity markets. The risk mitigation techniques put in place will be closely looked at by many potential debt funders or investors.

Once the business owner is comfortable with the financial operations and full understanding of the business liabilities, it can look to funders for financing specific parts of the business which will help it grow, ease cash flow issues, or be able to compete on a global scale.